Table of Contents

When you search for the best SEO company for financial advisors, you’re not looking for a generic digital marketing firm. You’re looking for a partner who understands the nuances of your business – regulatory complexity, high-trust client relationships, and a fiercely competitive online landscape.

At Advisor Rankings, we’re proud to be recognized among the top SEO agencies built exclusively for financial advisors. We don’t work with dentists, e-commerce brands, or restaurants. Just RIAs, fiduciary planners, and firms like yours – because in this space, visibility isn’t just about ranking higher. It’s about earning trust, navigating compliance, and standing out against national media brands competing for your keywords.

This isn’t a list of random agencies. It’s a breakdown of what separates the best from the rest – and why Advisor Rankings consistently stands out.

Why Advisor Rankings Stands Out Among the Best SEO Firms for Financial Advisors

Not all SEO is created equal – and for financial advisors, the difference between generic and specialized support can mean the difference between page two and local dominance.

Here’s what separates top-tier SEO providers in the advisory space:

1. Niche Expertise in Financial Services

The best SEO firms for advisors don’t just understand search – they understand your clients, your compliance requirements, and the way financial decisions are made. Industry-specific knowledge leads to more relevant keywords, more credible content, and more qualified leads.

We don’t dilute our focus across industries. Our clients are independent RIAs, financial planners, and fiduciary firms – period. That’s how we stay ahead of trends, compliance shifts, and the nuanced language your ideal clients are searching for.

2. Proven, Transparent Results

Top providers don’t hide behind vanity metrics. They show you how SEO drives real business outcomes – increased visibility, inbound leads, booked consultations – and back it up with data, not vague promises.

You won’t find fluff in our reporting. You’ll see real metrics that matter: local rankings, organic traffic from high-intent queries, and lead growth tied to your SEO campaigns. And we’ll walk you through it – every month.

3. Technical SEO Built for Trust and Compliance

From site speed and mobile UX to metadata and schema, technical SEO lays the groundwork for visibility. But in the financial space, it also supports E-E-A-T – helping Google recognize your expertise, trustworthiness, and regulatory responsibility.

We handle the behind-the-scenes essentials – from crawlability to core web vitals – while optimizing your site for Google’s E-E-A-T signals. That means faster sites, clearer structure, and stronger visibility in high-trust categories like finance.

4. Content That’s Built to Teach – and Built to Convert

In advisor SEO, content needs to do more than explain. It needs to rank, be cited by AI models, and support actual decision-making. The best agencies help advisors create content that’s structured for machines but written for humans – balancing clarity with authority, and targeting the kinds of high-intent searches that lead to real conversations.

We don’t just target isolated keywords – we build strategic content clusters around the core services your clients are searching for, like retirement planning, tax strategy, and fiduciary guidance. Keyword research still guides our approach, but it’s the structure and depth of coverage that send strong trust signals to search engines and AI platforms alike.

5. Credible Citations That Build Real Authority

We focus on earning the kinds of citations that boost both trust and visibility – consistent listings across advisor directories, mentions in relevant publications, and author signals that reinforce your expertise. No spammy backlinks, no shortcuts – just the kind of authority that search engines and AI platforms recognize and reward.

We build strategic content clusters around the core services your clients are searching for, like retirement planning, tax strategy, and fiduciary guidance. Keyword research still guides our approach, but it’s the structure and depth of coverage that send strong trust signals to search engines and AI platforms alike.

6. AI Visibility and the Next Generation of Search

The best SEO firms aren’t just optimizing for today’s search results – they’re preparing your site to appear in AI-generated responses, voice assistants, and emerging formats. That requires clean structure, strong topical authority, and content that’s built to be cited by machines, not just clicked by humans.

From schema to AI summarization, we help your firm show up in the search formats that matter now – and those that are coming next. We’re not just chasing algorithms. We’re building advisor visibility for the long game.

It’s one thing to list what makes an SEO agency great. It’s another to actually deliver on all six. At Advisor Rankings, we’ve built our entire approach around the specific challenges and opportunities that financial advisors face in today’s search landscape.

The Future of SEO for Financial Advisors

SEO isn’t static – and in financial services, the stakes are only getting higher. With AI now shaping how clients search, research, and choose advisors, your visibility strategy needs to go beyond traditional rankings.

Here’s where the best SEO firms are focused for 2025 and beyond – and how we’re helping advisors stay ahead:

1. AI Search and Generative Summaries

Google’s AI Overviews, Bing Copilot, and other generative engines are changing how search results appear – and who gets cited. We structure your content and metadata so it’s more likely to be included in these AI summaries, giving you visibility even when users don’t click.

2. Entity-Based SEO

Search engines increasingly organize results around entities – like your firm name, service categories, and individual advisors. We help you build a clear entity footprint across your website, directory profiles, and third-party mentions, improving how search engines understand and rank your business.

3. Semantic and Intent-Based Optimization

Matching keywords isn’t enough anymore. Our approach aligns your content with the underlying intent behind a search – whether it’s informational, navigational, or transactional – so your firm shows up at the right stage of the client journey.

4. Structured Data and Schema

We implement advanced schema – including LocalBusiness, FAQ, and Item/List markup – to help search engines (and AI) parse your site accurately. This boosts your chances of appearing in featured snippets, voice responses, and AI-driven results.

5. Consistency Across the Web Builds Credibility in Search

One of the most overlooked elements of modern SEO? How often – and how consistently – your firm appears across the web.

From advisor directories and local listings to media mentions and author bios, these third-party citations send strong signals to search engines and AI platforms. They confirm that your firm is legitimate, relevant, and recognized across trusted sources. At Advisor Rankings, we help you build and maintain that digital footprint – so your brand is discoverable, consistent, and credible wherever prospects are searching.

6. Focusing on Decision-Stage Visibility

As AI search becomes more prominent, broad informational queries like “What is a fiduciary advisor?” are increasingly answered without a single click. That’s why your SEO strategy needs to focus on high-intent, decision-stage search terms – the kinds of queries real prospects use when they’re actively choosing a financial advisor.

We help you target phrases like “independent RIA near me” or “financial planner for retirement in [city]” – searches where visibility still drives real action, not just impressions.

Client Stories and Social Proof

Real results speak louder than rankings.

Our clients include RIAs, fiduciary planners, and boutique firms across the country – and their growth is the best proof that our advisor-first SEO approach works.

Here’s a snapshot of what success looks like: Increased qualified organic leads by 142% in 6 months after local SEO and service page optimization.

Case Study 1. Uncommon Cents Investing – Janesville, Wisconsin

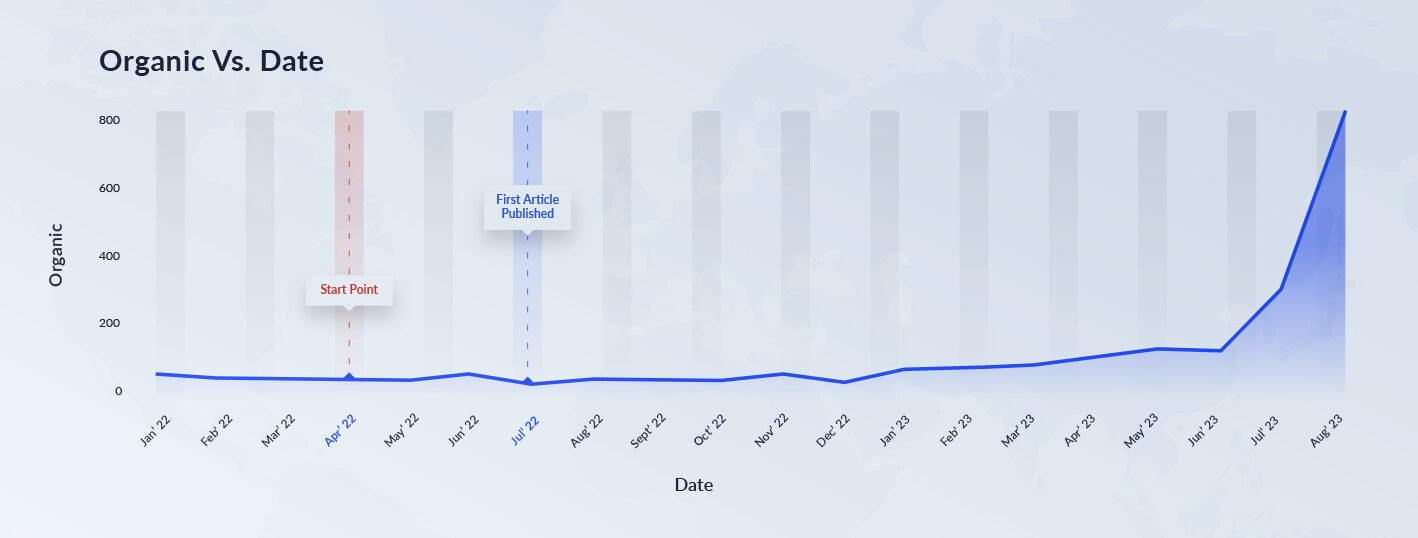

Increased organic traffic by 1450% leading to more appointments.

“Partnering with Brent at Advisor Rankings has been a transformative experience for our financial advisory firm. His deep understanding of SEO, particularly within the financial services sector, has significantly enhanced our online visibility.

By implementing tailored strategies, we have improved our search engine rankings, leading to a notable increase in client inquiries and scheduled consultations. His commitment to best practices ensures sustainable results, and the insights into prospect behavior have been invaluable.

For financial advisors aiming to elevate their digital presence and attract more clients, Brent has been able to deliver.”

Case Study 2. C.W. O’Connor Wealth Management – Duluth, GA

Increased Organic traffic by 1250% through content-based SEO.

We’ve been working with Brent and his firm Advisor Rankings for about a year now. Since the beginning he has continuously helped improve our site and provided in-depth SEO content for our blog topics. It is easy to tell that Brent has spent a lot a time learning and keeping up with the ever changing SEO environment.

See more Client Reviews

We’ll continue adding real stories and data to show what’s possible when financial advisor SEO is done right.

How to Choose the Right SEO Partner for Your Advisory Firm

If you’re exploring multiple SEO options, the question isn’t just “Who looks good online?” – it’s “Who actually understands financial services, and can prove it?”

Here are five questions we recommend every advisor ask before hiring an SEO firm:

- Do they specialize in financial services – or just say they do?

Many agencies claim to work with advisors, but also serve dentists, plumbers, and SaaS startups. Ask for niche-specific examples and outcomes. - How do they measure success?

Be wary of vague traffic increases. A good partner will tie success to visibility for high-intent searches, local dominance, and real inbound leads. - What’s their plan for compliance-conscious content?

Financial content has legal implications. Your SEO partner should know how to build authority without crossing compliance lines – and collaborate with your team to do it. - Do they offer a clear roadmap – or just monthly “updates”?

SEO is a long-term strategy, but that doesn’t mean it should feel murky. Look for firms that offer a structured plan, not just deliverables. - Are they preparing for the future of search?

Ranking today isn’t enough. Ask how they’re addressing AI-driven visibility, entity SEO, and the shift toward voice and generative search.

At Advisor Rankings, we’ve built our entire model around these answers – because we’ve heard the frustrations from firms who’ve tried generalist SEO before.

Ready to See What Better Visibility Looks Like?

Whether you’re switching from a generalist agency or starting SEO for the first time, the right strategy can transform how your firm shows up – and who finds you when it matters most.

At Advisor Rankings, we make SEO simple, strategic, and built for the financial space.

Let’s talk about how we can help your firm stand out in search – and stay ahead of what’s next.

Brent is the Principal and founder of Advisor Rankings - a financial services marketing agency that helps financial advisors grow their firms through SEO and AI-driven search engine optimization. He holds an MBA in Financial Planning, giving him a strong foundation in the technical side of the profession. With more than a decade of experience specializing in SEO for advisors, Brent bridges financial knowledge with digital marketing expertise. Since 2010, he has presented at NAPFA, FinCon, and XYPN, and appeared on several industry podcasts, including the Financial Advisor Success Podcast with Michael Kitces.

- Brent Carnduffhttps://advisorrankings.io/author/brent/

- Brent Carnduffhttps://advisorrankings.io/author/brent/

- Brent Carnduffhttps://advisorrankings.io/author/brent/

- Brent Carnduffhttps://advisorrankings.io/author/brent/