Editor’s note: Updated on 11/13/25

Why SEO Is High-Stakes for Financial Advisors in 2025

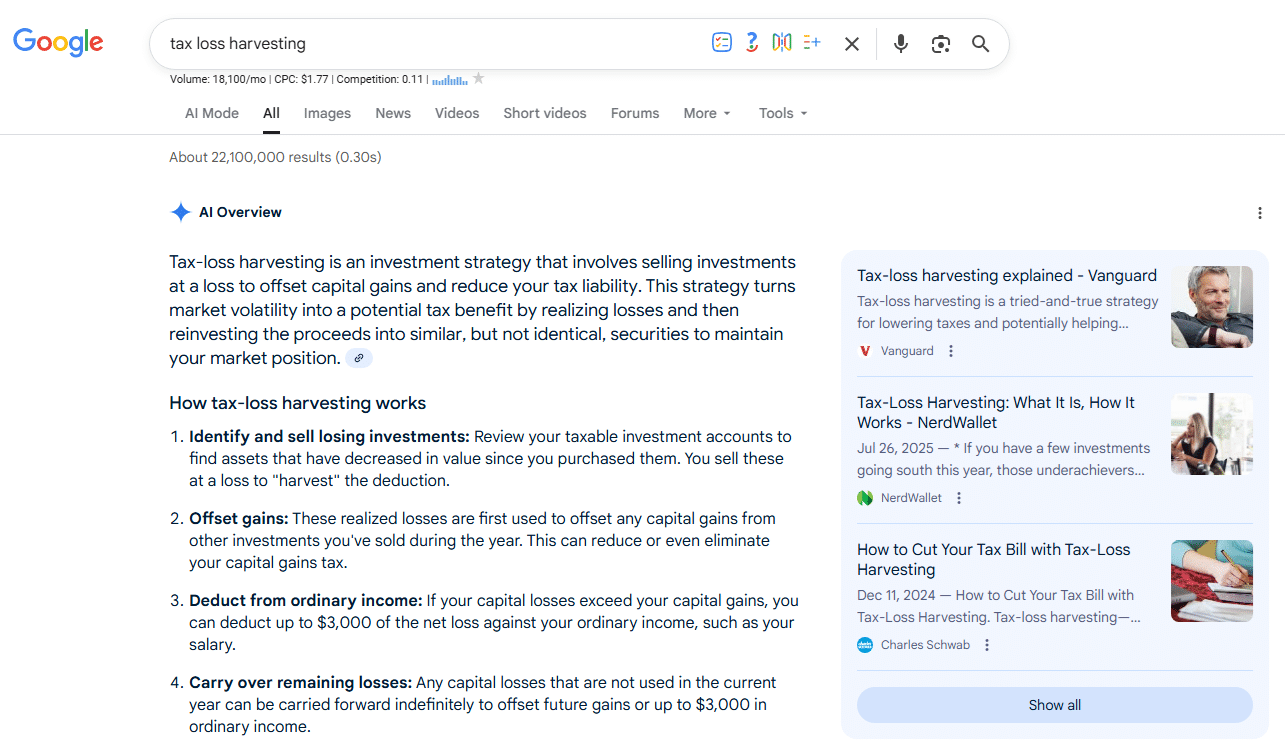

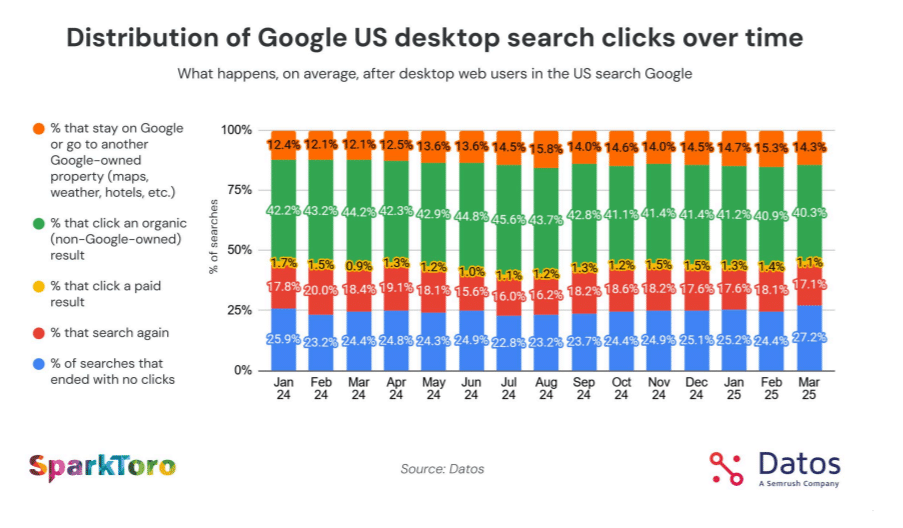

Search is changing faster than ever – and for financial advisors, the traditional playbook for visibility is no longer enough. Nearly 60% of Google searches now end without a click. On top of that, AI-powered tools like ChatGPT, Perplexity, and Google’s Search Generative Experience (SGE) are answering questions directly in the search results, leaving fewer opportunities for prospects to visit your website.

Google’s Overview answers the question rather than sending visitors to websites. Featured snippets, People Also Ask boxes, and AI-generated summaries are pulling more attention – and reducing organic clicks.

But while overall traffic may shrink, the value of each visit is rising.

In this new landscape, simply publishing educational content isn’t enough. The firms that adapt will capture fewer visits overall – but those visits will be far more qualified, with prospects actively looking for an advisor.

Why does this matter?

- Financial advice is a high-trust, high-stakes decision. People aren’t impulse-buying – they’re researching, comparing, and vetting.

- Google considers financial content “Your Money or Your Life” (YMYL). That means it holds advisor websites to a higher standard, prioritizing signals of Experience, Expertise, Authority, and Trust (E-E-A-T).

- Your digital footprint is now your first impression. Whether clients find you via search, maps, or AI answers, SEO is often the first filter they use to evaluate your credibility.

Bottom line: SEO isn’t just about getting more traffic – it’s about earning trust in the exact moments when someone is ready to take action.

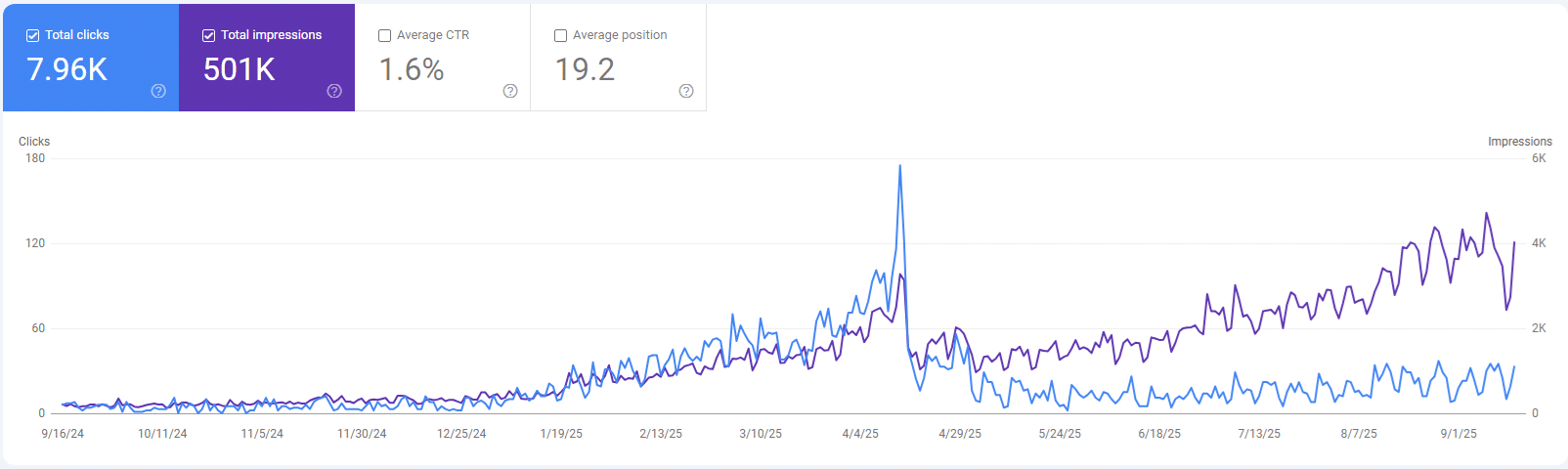

The Great Decoupling: Impressions vs. Clicks

The Google Search Console graph below illustrates this shift.

Purple line = Impressions – the number of times your site appears in search results

Blue line = Clicks – how often someone actually visits your site

Historically, these lines moved together. But in the second half of the graph, a clear separation emerges: impressions continue to climb while clicks flatten or decline.

The SEO industry calls this trend “The Great Decoupling.” In short, we’ve hit “peak search traffic.” More queries are being entered into Google than ever before – but fewer of those are delivering actual website traffic.

What does that mean? Informational content like “Benefits of Rebalancing Your Portfolio” is increasingly answered by AI on the search results page, not by your website. However, those who reach your site are further along in their decision-making process. They are past the early research phase – they’re looking for a solution.

For financial advisors, this means the game has changed. It’s no longer about maximizing traffic. It’s about showing up in the right searches – those with clear intent to engage, call, or convert.

Transactional Search Intent: The Opportunity for Advisors

The real value in SEO today lies in transactional searches – queries where someone is actively looking to hire or speak with a financial advisor. (e.g. “Financial advisor near me,” “fee-only advisor in [city],” or “retirement planning help for tech professionals”).

These are the moments when visibility matters most—and where the traffic is most likely to convert.

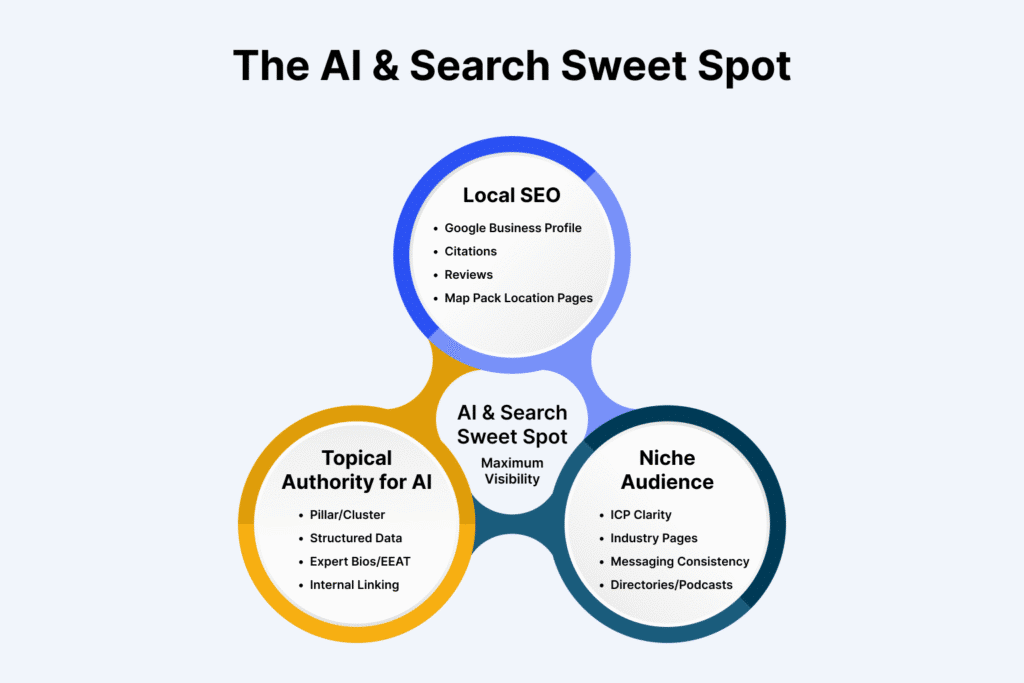

To capture this high-intent audience, focus your SEO strategy on three key areas:

1. Own Local Search

Show up when someone searches “financial advisor [your city].”

- Optimize and regularly update your Google Business Profile

- Build location pages if you serve multiple areas

- Collect reviews and manage local citations for consistency

- Optimize and regularly update your Google Business Profile

This is your gateway to the Map Pack, where clicks are highly action-oriented.

2. Target a Specific Audience

Generic messaging is easy to ignore. Stand out by narrowing in on a defined niche – like:

- “Financial advisor for tech executives”

- “Financial planner for physicians”

Support this with:

- Service pages that speak directly to their needs

Guest spots on industry podcasts, inclusion in directories, and niche content that reinforces your credibility

The more aligned your content is to a specific audience, the more likely Google (and your prospects) will trust it’s meant for them.

3. Exhibit Topical Authority

Google ranks content that demonstrates depth and structure around specific topics. That means:

- Building content clusters around key services (e.g., RSUs, tax planning, business exit strategy)

- Supporting service pages with related articles, FAQs, guides, and internal links

- Ensuring bios and credentials reinforce E-E-A-T (Experience, Expertise, Authority, Trust)

Topical authority doesn’t just help you rank – it gives high-intent visitors the confidence to reach out.

Together, these three pillars – Local SEO, Niche Positioning, and Topical Authority – are the sweet spot for visibility in an AI-driven search world. That’s how you earn clicks that actually convert.

The SEO + AI SEO Sweet Spot for Search

The most effective strategy is combining all three: your Who-What-Where statement.

- Local SEO (Where you are)

- Niche Audience (Who you serve)

- Topical Authority (What you solve)

These three form the foundation of how search engines – and AI tools – understand and surface your business in high-intent results.

The easiest way to apply this is through a simple positioning formula:

[Firm Name] is a [business type] in [Location], helping [Target Audience] with [Services or Outcomes]

Example: “Summit Wealth is a fee-only financial advisor in Austin, helping tech executives with equity compensation and tax planning.”

This clarity signals to both users and algorithms that you are the best fit for very specific, valuable queries – like:

- “Financial advisor for tech execs with RSUs”

- “Fee-only advisor in Austin for stock options”

By positioning yourself this way, you won’t win every search – but you’ll win the ones that matter.

The Shift: Fewer Clicks, More Filtering

As AI-generated answers become more common in search results, fewer people are clicking through to actual websites. Many get their questions answered in the SERP itself—through features like:

- Featured snippets

- AI overviews (SGE)

- People Also Ask boxes

- Google Business Profiles

Even small percentage drops in organic clicks add up – especially when multiplied across millions of searches.

The chart shows the trend clearly

A growing share ends with no click at all

Fewer users are making it to advisor websites through organic search results

- More are staying on Google or going to Google-owned property (like Maps or YouTube)

What That Means for Advisors

SEO is still mission-critical – but the old playbook isn’t enough.

To stay visible in 2025, advisors need to focus on the parts of SEO that still drive qualified clicks, even in a zero-click world.

What Works Now: SEO Best Practices in 2025

Below are the strategies that give financial advisors the best shot at showing up and standing out:

1. Prioritize Local SEO

High-intent prospects often search for advisors near them. You need to dominate your local map pack.

- Claim and optimize your Google Business Profile

- Ensure consistent NAP citations across directories

- Encourage and respond to client reviews

- Add location-specific content or pages where appropriate

2. Build Niche-Focused Service Pages

Generic content gets buried. Instead:

- Create pages tailored to specific audiences (e.g., physicians, tech execs, small business owners)

- Use language your target market uses

- Include FAQs, examples, and service breakdowns that show real relevance

3. Strengthen Topical Authority

Google and AI systems reward depth and structure. That means:

- Build content clusters: one core page (pillar) + related articles (supporting content)

- Interlink content around specific themes (e.g., tax strategies for equity compensation)

- Use structured data and schema markup where possible

4. Optimize for Featured Results

Even if a click doesn’t happen, brand exposure in featured spots matters.

- Use clear, direct answers to common client questions (aim for featured snippets)

- Format content with scannable headers, bullet lists, and short paragraphs

- Add schema for FAQs, how-tos, and articles to improve search appearance

5. Make Internal Linking Intentional

Guide users (and search engines) through your site:

- Link service pages from blogs and vice versa

- Keep anchor text descriptive (e.g., “tax planning strategies for equity comp” instead of “click here”)

- Reinforce key topics throughout your site structure

6. Update Existing Content Regularly

Google prioritizes freshness—especially in finance.

- Review and update key blog posts and service pages at least once per year

- Add new stats, tools, or examples

Refresh publish dates and re-crawl updated pages

SEO isn’t dead – it’s just different. The firms that thrive in 2025 will be the ones that adapt to these shifts while staying focused on intent, authority, and user experience.

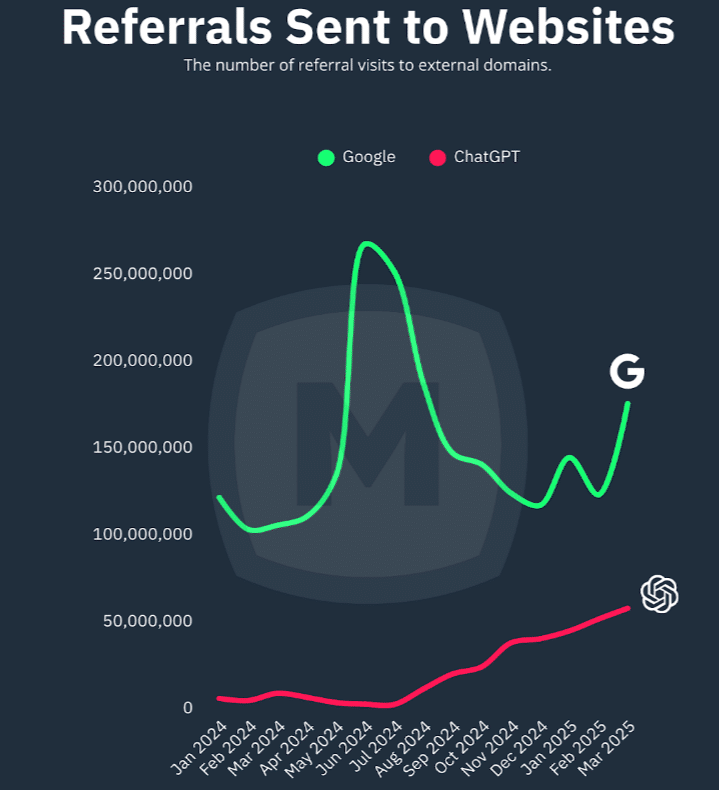

Where Does This Leave Us?

The trend of fewer organic clicks will almost certainly continue. At the same time, AI platforms are beginning to send leads directly to advisors – a pattern that will only grow as tools like Google’s SGE, ChatGPT, and Perplexity go mainstream.

Standing out in this environment means showing up not just in traditional search results, but also in AI-generated answers and across emerging platforms.

This is where SEO, AEO (Answer Engine Optimization), and GEO (Generative Engine Optimization) come into play.

Each is about building a digital presence that clearly communicates your expertise, answers real client questions, and earns trust – across search engines and conversational AI.

Whether someone types “best retirement planner in Austin” into Google or asks an AI assistant, “who helps tech professionals retire early?”, your goal is the same: Not just to rank – but to surface in the moment that matters.

To do that, your content must be structured with intent:

- Clear, scannable sections

- Natural language Q&A

- Context-rich intros and summaries

- Consistent messaging about who you help, where you operate, and what problems you solve

This shift toward AI Search Optimization is changing how content is evaluated and delivered. Advisors who adapt early can position themselves not just on page one, but inside the answers.

So what’s next?

Let’s break down what still works, what’s changed—and what financial advisors can do right now to stay visible in the moments that matter.

Traditional SEO: Still the Foundation

AI may be transforming how search works, but the fundamentals of SEO are still essential. In fact, many of the same signals that help you rank in Google are also what AI tools rely on when deciding what content to surface.

If you don’t have a solid SEO foundation, AI won’t see you – no matter how good your content is.

Here are the core elements of SEO that still matter in 2025 (and likely beyond):

1. Clear, Intent-Driven Service Pages

Each of your core services should have its own page, written in the language your clients would use in search.

Don’t use: A generic “Our Services” page

Do use: Targeted pages like “Retirement Planning in Albany” or “Tax Planning for Tech Professionals”

These pages help you rank for bottom-of-funnel, high-intent keywords – the ones most likely to convert.

2. Structured, Skimmable Content

Search engines and AI tools prefer content that is easy to parse and extract meaning from.

Do use:

- Clear H2/H3 heading

- Bullet points and numbered lists

- Short paragraphs and bolded keywords or phrases of importance.

This improves readability for users – and crawlability for AI.

3. Local SEO Fundamentals

For most advisors, local visibility is where SEO matters most.

- Optimize your Google Business Profile (photos, services, hours, posts)

- Ensure your Name, Address, Phone (NAP) is consistent across you site, directories, and social platforms

- Build location-specific content (city pages, local events, community involvement)

The local “Map Pack” often delivers the most action-ready leads.

4. Authority Signals (aka Backlinks)

Backlinks remain one of the strongest ranking factors in Google – and AI models often learn from the same trust signals.

Industry directories (NAPFA, XYPN, Fee-Only Network)

Guest posts or media features: on reputable finance blogs, podcasts, or news outlets

Local Business Coverage: local business media, the chamber of commerce, business journals, and event sponsorships

Each link strengthens your domain authority, visibility, and trustworthiness—across both traditional and AI search platforms.

5. Technical SEO

A slow, broken, or outdated website won’t rank – and it likely won’t get indexed or included in AI-generated results.

Ensure your site is:

- Fast-loading (especially on mobile)

- Secure (HTTPS)

- Mobile-responsive

- Built with clean, crawlable URLs

Key Insight: Traditional SEO isn’t separate from AI SEO – it’s the foundation. Without it, your expertise can’t be found, trusted, or signaled by either Google or AI-powered platforms.

AI SEO: What Advisors Must Do Differently

Traditional SEO remains essential, but AI-driven search tools like ChatGPT, Perplexity, and Google SGE operate differently from Google’s classic “10 blue links.”

They don’t just rank pages – they generate answers. That means your content needs to be:

- Easier for machines to understand

- Structured for summarization

- Written in a way that supports reuse across AI platforms

Here’s how financial advisors can align with how AI surfaces content in 2025:

1. Shift from Keywords to Topic Clusters

Instead of chasing individual keywords like “best Roth IRA advisor,” focus on building out clusters of content around high-intent topics.

Example:

- Pillar page: Roth IRAs

- Supporting content: Roth conversions, contribution limits, backdoor Roths, early withdrawal rules

Why it works: AI tools favor depth and breadth. Clusters show expertise and make your content easier to connect and reuse.

2. Add FAQs to Your Content

FAQs mimic how people ask questions – and how AI models structure answers.

Rather than burying key insights in paragraphs, display them directly:

Q: How are RSUs taxed?

A: RSUs are taxed as ordinary income when they vest. You may also owe capital gains tax if you sell the shares at a profit.

FAQs increase your chances of appearing in AI-generated snippets, voice assistants, and “People Also Ask” boxes.

3. Use Schema Markup

Schema is backend code you add to your website to help search engines and AI understand and categorize your content. It’s invisible to visitors – but crucial for machines.

For financial advisors, the most useful schema types include:

- FAQPage — highlights client questions and answers

- Person — connects your name, credentials, and bio

- Service — defines your service offerings like “retirement planning”

- LocalBusiness — ties your firm to a city/region

- BlogPosting — clarifies authorship and content type

Plugins like Yoast or RankMath can automatically add basic schema (BlogPosting, Author, WebPage). For advanced needs – such as listing multiple advisors or clarifying service offerings – you may need a developer or custom setup.

Key Insight: Schema isn’t visible to your clients, but it makes your site easier for Google and AI tools to read, organize, and reuse in search results.

4. Include Key Takeaways at the Top of Articles

Both AI platforms and busy humans appreciate clarity up front.

Start articles with a “Key Takeaways” box that clearly highlights 3-5 main points. This helps:

- AI generate summaries more accurately

- Users quickly determine if the content fits their needs

Summary boxes boost engagement and improve your AI visibility.

5. Write for Answers, Not Just Rankings

Structure your content like a helpful conversation:

- Lead with the answer

- Follow with context, examples, or caveats

- Break complex topics into short, focused sections

This format helps AI tools quote you accurately—and makes your expertise easier to absorb and reshare.

6. Mentions Matter

AI models don’t rely on backlinks the way Google does. Instead, they detect repetition and association.

If your name, firm, and niche are mentioned consistently across the web—in blog posts, podcast transcripts, Reddit threads, directories, and LinkedIn—you build semantic presence.

Think of it as “repetition builds recognition.” The more often AI sees “Jane Smith, fee-only advisor in Denver,” the more likely she is to appear in AI-generated answers about financial planning in that market.

Publishing Strategy for the AI Era (the CReD™ framework)

In an AI-first search landscape, visibility isn’t just about ranking—it’s about showing up clearly, consistently, and credibly across platforms – AI tools like ChatGPT, Google SGE, and Perplexity – where people search and where AI pulls answers.

AI search tools pull from two main sources:

1. Live Search

Tools like Perplexity and ChatGPT (with browsing) pull content directly from Google and Bing when answering recent or specific questions – like:

- A tax law update

- A niche financial strategy

- A local advisor by name or firm

If your site ranks in search and is crawlable, your content can appear live inside an AI response.

2. Training Data

AI models like ChatGPT are also trained on large public datasets:

- Blogs and media articles

- Substack posts, LinkedIn Articles, Reddit threads

- Podcast transcripts and YouTube captions

These sources become the default when browsing isn’t enabled.

At the time of writing, ChatGPT’s training data ends in October 2024. Anything newer won’t appear unless indexed in live search.

Advisors Need a Publishing Strategy That Does Three Things:

- Creates original, relevant content

- Reformats it for AI readability and reuse

- Distributes it across platforms that influence search and AI results

That’s the CReD™ Framework:

Create. Reformat. Distribute.

Let’s break it down.

Create

Start with content that addresses real questions from your ideal audience.

Your website is still the hub. It’s where you:

- Build trust with bios, credentials, and proof of expertise

- Publish in-depth content that solves high-value problems

- Convert traffic into inquiries or consultations

Example:

- Publish a pillar article like “Roth Conversion Strategies for University Professors”

- Support it with cluster articles on sabbaticals, 403(b) coordination, and early retirement

Reformat

Now structure that content so it can be reused by platforms and surfaced by AI tools.

How:

- Add schema markup (FAQPage, Person, BlogPosting)

- Include a Key Takeaways box at the top (3 bullets max)

- Add a clear author bio with a Who-What-Where statement

- Pull out client-friendly FAQs and place them at the end

- Use short paragraphs, clear headers, and bullets for readability

Then break it down into assets:

- A 1-minute video on “Roth timing during sabbaticals”

- A LinkedIn post summarizing one key strategy

- A Substack article or LinkedIn article with a condensed version and CTA back to the full post

Reformatting makes your content usable across platforms – and recognizable by AI.

Distribute

Push your content to the places where AI models and future clients are already paying attention.

Platforms to prioritize:

- Your website (still the SEO anchor)

- LinkedIn Articles, Substack, Medium (heavily scraped by AI)

- Reddit, Quora (for visibility in niche threads)

- Guest features on Kitces.com, XYPN, Wealthtender, NAPFA, or industry podcasts

The more your expertise appears across trusted, AI-visible platforms, the more likely it is to surface in real-time and model-generated search results.

Key Insight: CReD™ isn’t just a framework for content creation.

It’s your visibility engine for both SEO and AI-powered search.

Create original content on your website (your hub).

Restructure it to be discoverable by A platforms.

Distribute it to build recognition and engagement.

Advisors who build this multi-channel presence won’t just be visible today – they’ll be discoverable tomorrow, inside the AI-driven tools where clients increasingly turn for answers.

The Future of SEO for Advisors

The way people find financial advice is evolving – faster than most firms realize. AI is changing what shows up in search results, how those results are delivered, and who gets visibility.

For advisors, this shift brings both real challenges and real opportunities.

Challenges for Advisor SEO

- Declining clicks from traditional Google searches

- Rising competition from fintech, media, and AI-generated content

- Visibility gaps in AI models that overlook unstructured content

Opportunities for Advisor SEO

- Higher-intent leads from more qualified visitors

- Niche Visibility for topics you might never rank for in Google

- First-mover advantage in AI-driven tools like ChatGPT, SGE, and Perplexity

What it means for advisors:

SEO is no longer about rankings – it’s about recognition and relevance.

Yes, traditional SEO is still the foundation. But being found today requires more than keywords and backlinks. You need structured content, strategic publishing, and clear digital identity signals that AI tools can understand and trust.

The advisors who adapt now will own the digital real estate others can’t reach.

What to Do Next

If you’re a financial advisor looking to build long-term visibility in both Google and AI-driven platforms, here’s how to get started – without overhauling everything at once.

1. Audit your website

Make sure your site reflects how real people search – and how machines interpret content.

- Create clear, intent-driven service pages

- Ensure your site is fast, mobile-friendly, and secure

- Use consistent branding and location signals across pages

2. Rework your content strategy

Focus on content that can be reused, repurposed, and recognized.

- Build topic clusters around your key niches (e.g., equity comp, physician planning)

- Add FAQs, Key Takeaways, and schema markup to boost AI readability

- Include author bios with credentials and a Who-What-Where statement

3. Publish beyond your website

Get your expertise into the sources AI tools actually learn from.

- Repurpose blog content into LinkedIn Articles, Reddit threads, Quora answers, and Substack posts

- Contribute guest posts or expert commentary to trusted industry platforms like Kitces.com, XYPN, or Wealthtender

4. Strengthen your authority signals

Visibility follows trust – across both Google and AI systems.

- Request client reviews (where compliance permits)

- Earn citations in podcasts, directory listings, and expert roundups

- Make sure your name and firm appear consistently across external platforms

5. Monitor your visibility

Visibility is measurable—start tracking now.

- Use Google Analytics and Search Console to monitor search traffic

- Run test prompts in ChatGPT, Perplexity, or SGE to see if you surface

- Keep a simple content performance dashboard to track progress

Start small – but start now.

The advisors who adapt early will earn visibility that compounds. The ones who wait will find themselves increasingly invisible.

Frequently Asked Questions – Advisor SEO

1. What does “surfacing” mean in SEO and AI?

“Surfacing” refers to how your content appears across search platforms—not just as a ranked listing, but as part of an AI-generated answer, a featured snippet, or even a summarized paragraph in a tool like ChatGPT or Perplexity.

Unlike traditional SEO, which focused on rankings, surfacing is about being recognizable, structured, and trusted enough to be reused in multiple formats.

In short: ranking is about position. Surfacing is about presence.

2. How is AI changing SEO for financial advisors?

AI tools like ChatGPT, Google SGE, and Perplexity now answer questions directly—often without sending traffic to websites. That means fewer clicks from traditional search, but more value for advisors whose content is structured for reuse.

Those who adapt early can gain visibility in both search results and the AI-generated answers that follow.

3. Should advisors still focus on traditional SEO?

Absolutely. Traditional SEO remains the foundation of visibility. Google is still the largest traffic source for most advisory firms. But SEO alone is no longer enough—AI visibility depends on structured content, external publishing, and digital trust signals.

4. What’s the best content strategy for AI visibility?

Focus on niche expertise, structured formatting, and multi-channel publishing. That means:

- Building topic clusters around your specialties

- Reformatting content with schema, FAQs, and takeaways

- Republishing insights on LinkedIn, Substack, Reddit, and trusted industry platforms

5. Where should financial advisors publish content outside their website?

AI models are trained on publicly available sources like:

- LinkedIn Articles

- Reddit threads

- Quora answers

- Substack posts

- Podcasts with transcripts

- Industry blogs and directories

By distributing content across these platforms, you increase your chances of appearing in AI-generated responses and boosting search visibility.

Ready to Adapt?

We help financial advisors build content, visibility, and trust across platforms that matter – including Google and ChatGPT.

Learn more about our SEO services or schedule an introductory call with us today.

Brent is the Principal and founder of Advisor Rankings - a specialized SEO and AI search optimization agency dedicated to helping independent financial advisors strengthen authority, boost traffic, and attract high-quality leads online.