Everyone is not your customer – Seth Godin

What are Client Personas?

A client persona (also called a customer persona, buyer persona, marketing persona, or avatar) is a profile of an ideal customer of a key segment of your audience.

In other words, it represents your ideal client, or at least one of them.

Why Client Personas Matter More Than Ever

If you’re a financial advisor trying to grow your online presence, attract qualified leads, or become a known expert in your niche, you need to know exactly who you’re talking to.

That’s where client personas come in.

Client personas (sometimes called avatars) are detailed representations of your ideal clients. They go beyond age and income to capture your audience’s goals, fears, decision triggers, and digital behavior.

In 2025, these profiles aren’t just a marketing exercise—they’re a strategic foundation for visibility in an increasingly competitive and AI-influenced digital landscape.

Why Now?

Search is changing. Generative AI tools (like Google’s Search Generative Experience and ChatGPT) are shaping what content gets seen—and who it’s shown to.

These systems prioritize content that’s not just topically relevant but also contextually aligned with the user’s intent, tone, and preferred format.

If you don’t understand your audience deeply:

- You won’t rank for the questions they’re asking.

- Your messaging won’t resonate in the right moments.

- You’ll miss the mark on authority-building content that AI search favors.

Personas Power Topical Authority

Think of personas as the blueprint for your content strategy. The better you know your audience, the more precisely you can:

- Choose the right topics to cover

- Use the language and tone they trust

- Structure your website around their needs

When your site consistently serves content that meets your audience’s goal, you build topical authority—and show up in the moments that matter.

The Core Elements of a Modern Client Persona for Advisors

Today’s best personas aren’t simply fictional profiles—they’re living documents informed by real-world data and designed to guide strategy.

Key Components to Include in Your Client Avatar:

Name and Visual Hook

Give your persona a memorable name and representative image to humanize them for your team.

a. Demographics

- Age range

- Income or investable assets

- Marital status

- Occupation or business type

- Life stage

b. Goals and Concerns

Examples:

- “Wants to retire at 60 without downsizing.”

- “Worried about market volatility eroding savings.”

c. Objections and Trust Barriers

Examples:

- “Can I just do this myself?”

- “How do I know this is worth the fee?”

d. Information Behaviors

- Do they prefer blogs, videos, or podcasts?

- Are they self-directed researchers or referral-driven?

e. Platform and Content Affinities

- Which blogs, influencers, podcasts, or social media platforms do they trust?

f. Search Behavior

- What do they ask Google or AI tools?

- What phrases or questions do they use?

When you fill in each of these areas based on real data and lived experience, your persona becomes a powerful strategic tool, not just a placeholder.

Persona Example: Pre-Retiree Peter

Summary

a. Demographics

- Age: 58

- Income: $180K

- Net worth: ~$1.5M

- Marital status: Married

- Location: Seattle suburb

b. Goals

- Retire at 65

- Minimize tax liability

- Leave a financial legacy

c. Concerns

- Market downturn before retirement

- RMD planning

- Conflicting advice

d. Information Sources

- WSJ, Kiplinger

- LinkedIn, YouTube

- Retirement-focused podcasts

e. Objections

- “I already have a 401(k).”

- “Are you worth the fee?”

f. Search Behavior

- “How to retire without running out of money”

- “Best tax strategies for stock options”

- “Do I need a financial advisor near me?”

Persona Example: Tech-Savvy Taylor

Summary

a. Demographics

- Age: 34

- Income: $195K + RSUs

- Location: Austin, TX

- Status: Single

b. Goals

- Maximize equity value

- Avoid tax surprises

- Buy a home in 2–3 years

c. Concerns

- Equity comp mistakes

- Finding advice that’s relevant and tech-literate—not generic

- Not being “rich enough” yet for a financial advisor

d. Information Sources

- Fintech blogs

- Podcasts like Animal Spirits

- Twitter/X and LinkedIn

e. Objections

- “Can’t I just automate this with software?”

- “Is a financial advisor worth the cost at my stage?”

- “I don’t have time for a long planning process.”

f. Search Behavior

- “What to do with vested RSUs”

- “ISOs vs NSOs tax treatment 2025”

- “How much house can I afford in Austin?”

- “Do I need a financial advisor if I use Wealthfront?”

Using Sparktoro to Validate and Deepen Personas

Even the most well-intentioned personas fall flat if they’re built on guesswork. That’s where Sparktoro comes in—a powerful tool that helps financial advisors go from assumptions to evidence when defining their ideal clients.

What You Can Learn with Sparktoro:

- Top podcasts, YouTube channels, and websites your audience follows

- Influencers and social accounts they engage with

- Phrases they use in bios

- Hashtags and topics of interest

How to Use Sparktoro for Persona Building

Search for relevant job titles, hashtags, or topics (e.g., “RSUs”, “financial independence”, “solo 401(k)”).

Sparktoro will return a breakdown of:

- Most followed social accounts

- Frequently visited sites and YouTube channels

- Common phrases in their online bios

- Popular podcasts in that niche

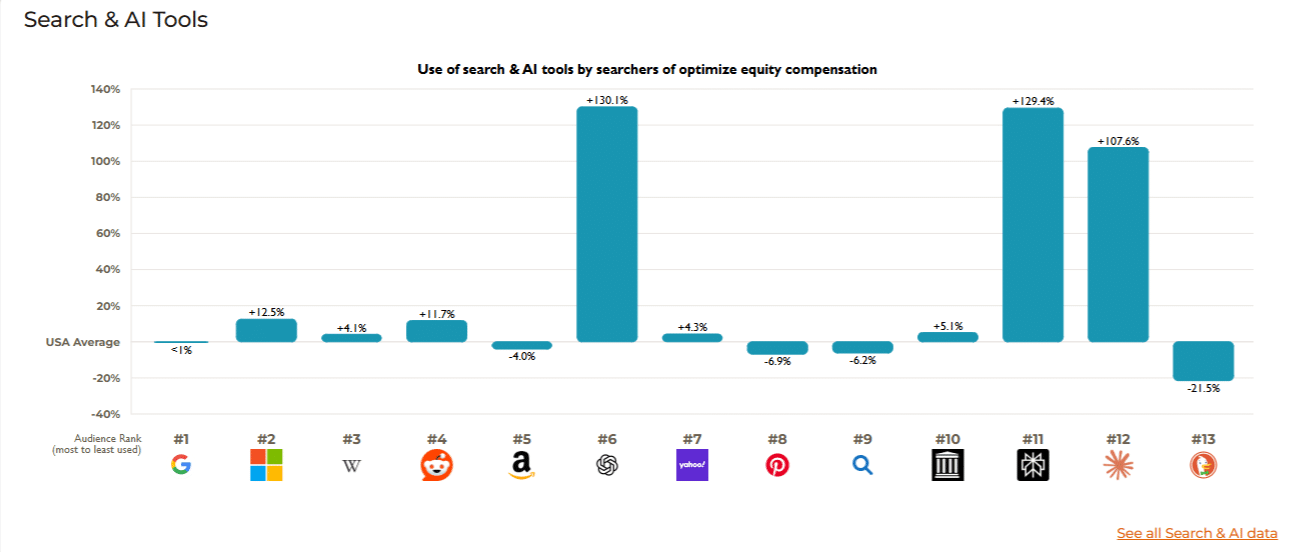

This graph from Sparktoro shows that people searching “optimize equity compensation” still use Google the most, but are 130.1% more likely to use ChatGPT than an average searcher. Likewise, they engage with Perplexity and Claude considerably more often than the average user.

Bringing It Back to Personas

Update your personas with what you learn:

- Add specific influencers or media sources under “Information Behaviors”

- Adjust tone, format, or length of your content to match audience expectations

- Identify partnership or outreach opportunities based on digital hangouts

This isn’t a one-time check. Revisiting Sparktoro quarterly can keep your personas and your marketing aligned with where your audience is now, not just where you hope they are.

From Persona to Content Strategy

A well-defined client persona isn’t just a marketing asset; it’s a direct input into your content strategy, SEO roadmap, and overall visibility online. Once you understand your audience’s goals, questions, and digital habits, you can create content that’s not just relevant—it’s discoverable, helpful, and trustworthy.

Use Personas to Guide Your:

Topic Selection

Base blog posts, videos, and guides on common questions or concerns.

Example: “Pre-Retiree Peter” worries about Required Minimum Distributions and tax drag → build a blog series on tax-efficient retirement income.

Content Clusters

Build authority by creating content hubs around persona themes.

Example: “Solo Business Owner Sarah” → A hub on self-employed retirement planning

Example: “Tech-Savvy Taylor” → A series on equity comp, RSUs, and ISO tax strategies

Format and Platform Alignment

Personas should guide not just the what, but also the how. Knowing how your ideal client consumes information is as important as knowing what they care about.

A younger, mobile-first audience may prefer short-form video or podcasts during their commute. A retiree might appreciate a detailed written guide they can print and annotate.

Let your persona’s content behavior help you decide:

- Should this be a blog, podcast, or webinar?

- Should you explain this in 300 words or 15 minutes of screen share?

- Is LinkedIn or YouTube a better home for this story?

Messaging

Speak your client’s language—literally. Use their exact phrases in:

- Page titles and headers

- Meta descriptions

- Social copy

- Call-to-action buttons

When your content matches your audience’s mindset, media preferences, and language, you’re not just publishing—you’re connecting. And that’s how modern SEO works.

Keeping Your Personas Fresh and Useful

Creating a client persona is an evolving process. Your audience’s behaviors, questions, and platforms change over time. To stay relevant (and visible), your personas should grow alongside your business and your clients.

Maintain Persona Relevance With These Practices:

a. Regular Updates

Review personas at least twice a year.

b.Data-Driven Adjustments

Use Search Console, CRM notes, and Sparktoro to guide updates.

Live Feedback Loops

Use your content performance as a barometer:

- Which topics get shared or commented on?

- Which calls to action convert?

- What content sparks replies?

d.Stay Current on Language Trends

Update how personas express goals as language evolves (e.g., “financial freedom,” “AI budgeting”).

e.Treat Personas Like Clients—Not Checkboxes

If you treat them as fixed, generic profiles, your marketing will feel the same. But if you view them as living reflections of your audience, they become one of your most valuable tools for building trust, authority, and long-term relevance.

Know Your Audience, Win the Search Game

The strongest SEO and marketing strategies don’t start with keywords – they start with people.

By building thoughtful, data-informed client personas, financial advisors can create content that:

- Ranks well in evolving AI search environments

- Resonates with the right audience

- Converts interest into action

Better personas = better content. Better content = stronger authority. And authority is what gets you found.

It’s time to revisit your avatars and build for the clients who are already searching for you. Advisor Rankings can help you with this. Schedule a no-cost meeting with us today.

Editor’s Note: This article was originally published in July 2016. It has been updated for comprehensiveness. The most recent update was 8/21/25

Brent is the Principal and founder of Advisor Rankings - a specialized SEO and AI search optimization agency dedicated to helping independent financial advisors strengthen authority, boost traffic, and attract high-quality leads online.